The current system of typing figures for the VAT return into the HMRC portal is being withdrawn. Instead software will be needed to collate the information required, prepare the return and send the return.

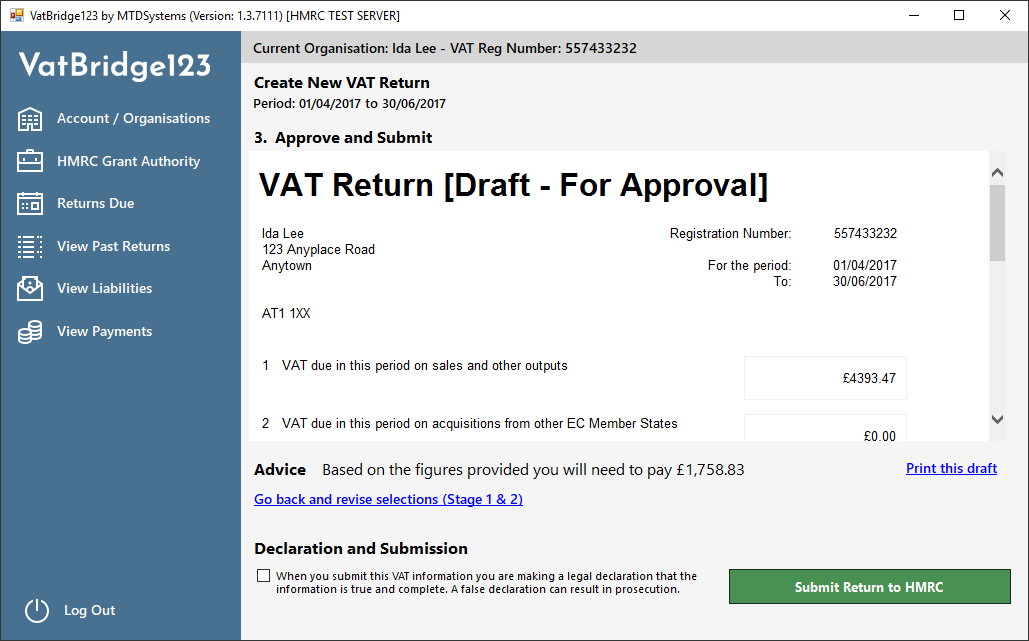

VatBridge123 is a simple to use solution to this problem and is compatible with most accounting systems and spreadsheets which means there is no need to change your current accounting practices.

For VAT registered Small Businesses whether Sole Traders or Limited Companies.

Download For Windows

If you currently use a spreadsheet or accounting software it’s possible to submit your vat return in less than 60 seconds!

That’s it!

VatBridge123 comes pre-loaded with a free credit which means you can make a VAT return straight away and fully evaluate the software with no cost or commitment.

Furthermore, VatBridge123 works on a Pay-As-You-Go basis so you can use it as much or as little as you like and only pay for what you use. There’s no need to create an account or commit to a fixed duration – simply buy credits (see pricing below) when you need them.

If you currently use spreadsheets or an accounting package then you are all set. Simply add VatBridge123 to your existing system and, with a few clicks of the mouse, you are ready to submit your returns.

Our software is HMRC approved and is listed on HMRC’s list of software suppliers supporting MTD for VAT. VatBridge123 can be used in conjunction with any accounting software packages.

If you currently use a manual system of record keeping then, from April 2020, as well as sending in your VAT return digitally your accounting records will need to be kept in a digital format. We are happy to provide you with a free demonstration spreadsheet which demonstrates just how easy digital book keeping and preparing VAT returns can be – please contact us for more information.

No need to change your current book keeping system. Compatible with all major accounting software and can integrate with any current spreadsheet based book keeping system.

No contract or registration. Simply buy credits as you need them, download the software and complete your return.

Free credit included to allow you to test the software.

Tested by HMRC and one their list of approved software suppliers.

You data is only every stored on your computers and is transmitted directly and securly from there to HMRC only.

If you are not familiar with digital record keeping use our Free spreadsheet to get you started.

Each Credit is valid for one VAT return.

VatBridge123 has a simple pricing model: you pay only for what you need! Our Pay-As-You-Go service helps small businesses reduce their accounting costs by only paying for what they use.

No monthly subscriptions. No sign up. No commitments.

You can submit one VAT return for your business for FREE with no strings attached as the software comes pre-loaded with a free credit.

If you decide to purchase you will be emailed a list of the credit codes that you have purchased. Simply click the ‘Add / Manage Credits’ button on the ‘Organisations’ screen and cut and paste the codes from the email into the box provided on screen.

Agents (accountants, bookkeepers, tax preparers) - Contact us for bulk pricing details and more information about how we can work with you to help your clients.

Contact UsIf you currently use spreadsheets (or other software) for your accounting and VAT returns then you simply need to add VatBridge123 and with a few clicks of the mouse you are ready to submit your return. VatBridge123 will digitally extract data from your current accounting records and submit them digitally to HMRC.

We can provide you with reliable , secure and compliant software for your clients whether they submit their own VAT returns or you do it for them. Just email us at info@mtdsystems.co.uk telling us how many VAT registered clients you have and we will send you a quote and information on how we can help you improve your service to your clients.

Prior to April 2020 you just need to download VatBridge123, copy your VAT return information onto a spreadsheet and follow the instructions to form a digital ‘bridge’ between your manual accounts and HMRC. However you will need to start keeping your accounting records digitally as soon as possible so that from April you will be familiar with digital record keeping and be compliant with the new digital legislation.

Keeping records digitally does not mean additional work in fact it can make your record keeping task much quicker and easier. No more adding up columns of figures. With your first purchase will send you a Free spreadsheet which demonstrates just how easy digital book keeping and preparing VAT returns can be.

Download the software installer below. Follow the installation instructions to install the software on your computer. Requires a system with Windows 7 or later.

Download For WindowsDo you have questions about the software? Fill in the contact form and we'll get back to you quickly.

Contact Us